What is EDI?

According to a little internet research we conducted, in the 1960s, the U.S. transportation industry adopted and developed Electronic Data Interchange (EDI) to enable thorough and accurate communications between multiple companies’ computer systems. Its objective was to standardize electronic transmissions between customers and vendors. According to UNUM, the insurance industry adopted the use of EDI after the Health Insurance Portability and Accountability Act of 1996 (HIPAA) required these standard formats be set for a variety of transmissions and code sets for transferring insurance documents. Today, EDI is widely used across many major industries. EDI enables companies to send information digitally from one business system to another, using a standardized format. The term EDI describes both the transmission of the data as well as the translation into a standard data format. EDI documents can flow straight through to the appropriate application on the receiver’s computer and processing can begin immediately.

Why is it Useful?

Every business changes over time. In order to succeed, they need to adjust to industry trends, and align their employee benefit offerings to meet employee expectations. With these changes, operational tasks like benefits enrollment are becoming increasingly time-consuming, erroneous, and more complex. As such, employers today are looking for ways to achieve their business objectives through the help of solutions that offer agility, configurability, and ease of connection. The technology behind EDI connection includes benefits for all major players in the health insurance ecosystem.

These benefits include:

Cost Savings: A key benefit of EDI is the reduction, or elimination of manual processes. By automating the flow of information and reducing human interactions, EDI allows costly resources (manpower) to be dedicated to core functions, increasing workplace productivity and reducing labor costs. Further, because paper documents are replaced by EDI transmissions, expenses associated with paper, printing, reproduction, storage, filing, postage, and document retrieval are all reduced or completely eliminated.

Accuracy: The application of EDI to automate data transfer drastically reduces the number of errors in data input by decreasing the amount of human involvement in the processes. The root of most data errors is the keying in of data from a paper document into an internal business system. The electronic capture of business documents enables data to be fed directly into internal systems without relying on error-prone, manual re-keying, which is required when you use paper or digital forms. Having more accurate data means that the entire business cycle is more efficient, and your groups will appreciate your ability to deliver enrollment documents accurately.

Security: EDI makes the exchange of business or personal information more secure by using communications protocols for transferring data, which include encryption and other security measures, like digital signatures. This is one reason why HIPAA encourages the widespread use of EDI in healthcare and benefit enrollment systems.

Speed: Some of the benefits of EDI solutions are quite straightforward. The speed in which information flows with EDI systems is a clear example of that. Electronic documents are delivered far more quickly than their paper-based counterparts resulting in faster turn around, happier customers, and a competitive advantage. With an EDI solution, there are no delays due to different time zones and incoming enrollment and enrollment changes are created automatically, not requiring user input or taking up employee time. Since the turnaround time of processing EDI is rapid, you can share information such as enrollment status, plan information or employee information between two parties instantly. This allows for easier planning and the ability to respond to or make changes on demand.

Management of Information: EDI also provides a data trail. Changes to benefit enrollment can easily be tracked and compiled for further manipulation and analysis. Transmissions and benefit enrollment information can then be assessed for trends, errors, or redundancies, providing actionable information to help guide business management and benefit offering decisions.

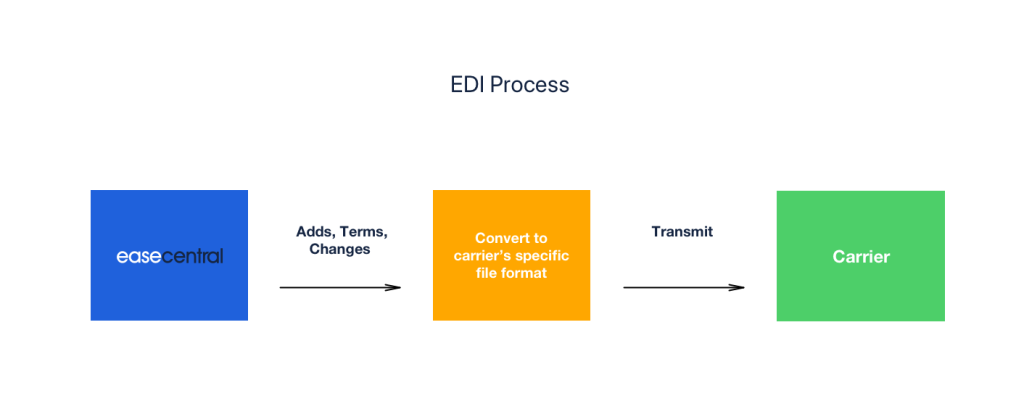

How does Ease use EDI?

With EDI, managing changes to enrollment in Ease is easy. Data changes are transferred from our system to the carrier, and then from the carrier back to Ease. Through the use of carrier connections, all updates and changes are managed in one system using an Ease login. Once set up, Ease will send the carrier any initial notification or qualifying event automatically on regularly scheduled report files. This ensures easy, accurate data transfer and up-to-date records.

Ease uses two processes to enroll and transfer enrollment data changes to and from our system to the carrier.

- Direct Submission: Our main tool for transfer is Direct Submission. Direct submission is used for new enrollment: when enrolling in a new plan, all employee enrollment data, is sent directly to the carrier. This results in more accurate submission of data, a reduction in delays, and faster resolution and processing from carriers.

- Carrier connectivity: After direct submission, any changes made to enrollment (adding a dependent, change of address, change in plans, etc) are updated through carrier connectivity. These changes are sent directly to the carrier in the system without any paper forms, faxing, or manual data entry.

Direct Submission with carrier connectivity creates a frictionless benefit experience.

There are different methods that Ease uses for enrollment submission to various benefit providers:

- Submit to a GA: Using this method, a broker can submit enrollment data to a General Agent and the General Agent submits to the carrier using EDI. When submitting to a GA that accepts Direct Submission, there is no need to submit or key in applications to carrier spreadsheets, saving you time.

- Census File (CSV): Employee enrollment data is completed and generated into a pre-formatted Census File. The broker then downloads the Census File to send to the carrier for submission. Census File’s are used less frequently and are often an alternative import and export format to the carrier’s default file type.

- Access Carrier System Within Ease: With this method, the employee enrolls in a benefit directly in the carriers enrollment system via Ease. The benefit selection is then sent back to Ease in real-time so employees can see their cost per pay period with the new plan.

- Third-Party EDI: A broker usually sets up a third-party EDI service that connects and translates enrollment information for all of a group’s plans. With third-party EDI, employee enrollment information is entered in Ease and sent to the third-party, which translates each plan and submits to the carrier. This enables brokers to submit enrollments and changes for a group with multiple plans without manual work.

- Straight EDI: With straight EDI, enrollment information is sent directly from Ease to a carrier’s database. After the employee submits their enrollment information, the carrier sends that information back to Ease. When changes in employee enrollment are made (employee has a child, marriage, etc) these changes are easily adjusted. This information is also sent direct to the carrier in many cases.

How does EDI help you?

Carrier connectivity provides several benefits to brokers and their groups. Ease is working to increase connectivity with partners and carriers to simplify and speed up enrollment.

What are the benefits of using EDI?:

- Through EDI, the enrollment submission process becomes largely automated. This technology brings all the necessary forms and information together in one spot, creating a single point of data entry; making it easier to get a business on the books.

- With physical enrollment forms no longer necessary, enrollment periods can be reduced by up to 75% through the elimination of error-prone paperwork, and enrollment data being sent directly to the carrier.

- Because benefit enrollment documentation is received and processed within minutes, employees get their enrollment information and member ID cards faster. Keeping employees more informed helps increase employee engagement, and in turn, increases their loyalty to their employer.

- Throughout the year, any employee benefit change (i.e., enrollment change, mid-year life event, address change, or payroll changes) is easy to manage. After you or a co-admin process the benefit changes in Ease, the information is transmitted automatically to the carrier with no special upload or update actions from HR administrators.

- Employers of all types are looking for better ways to connect their HR and payroll systems to their carrier’s systems. They want processes to be more streamlined and simpler to manage. EDI helps clients lower costs, improve processes, reduce administrative work, and helps broaden your partner portfolio and HR service delivery, all while maintaining excellent service.

- As healthcare continues to become more complex from constantly changing rules and regulations, streamlining essential reporting tasks can pave the road to a smoother, faster, and more efficient open enrollment season. Through the use of EDI, all data history is tracked and available to use for reporting.

- You can offer your clients better security. EDI offers a range of options for secure data transmission, and focus on the accuracy and integrity of the data, giving HR administration and employers peace of mind.

A business using EDI is a business that is on the right path for growth

For more information on EDI, or to learn more about Ease’s many carrier partners, be sure to check out the Marketing Resource Library.