One of the most challenging aspects of employee benefits is the employer’s responsibility to meet and maintain compliance with evolving federal and state laws, rules, and regulations. The Affordable Care Act (ACA) has added to the already overwhelming amount of mandatory notices and documents required for employers to remain compliant. The Employee Retirement Income Security Act (ERISA) is no exception to this trend, presenting further challenges to employers.

Employers are struggling to keep up with the changes taking place year after year, often resulting in penalties and administrative burdens. Employers are looking to their brokers for compliance support. Brokers are in a unique position to provide compliance tools and encourage their groups to be proactive about reporting.

This 101 lesson will walk you through important information surrounding different compliance policies and penalties your groups face, the evolving role of the broker, and how brokers can help their groups stay compliant by using Ease.

Section 1: The Evolving Role of the Broker

Section 2: Compliance Policies and Penalties

Section 3: What is ACA?

Section 4: Tackling ACA Compliance Issues with Ease

Section 5: What is ERISA?

Section 6: Tackling ERISA Compliance Issues with Ease

The Evolving Role of the Broker

Gone are the days when implementing employer-based health insurance coverage involved a relatively simple transaction between an employer and their benefit broker. As employers struggle to keep up with the regulatory changes that impact their group health plans, many turn to their group benefits insurance broker for help with ACA, ERISA, COBRA, and HIPAA compliance requirements.

In an attempt to satisfy this demand, many brokers have expanded service offerings to address their clients’ evolving needs. Some of these solutions include technology, compliance, communication, and reporting services.

Compliance Policies and Penalties

The Internal Revenue Service (IRS) and Equal Employment Opportunity Commission (EEOC) have strict reporting requirements for employers that change each year. Compliance with both ERISA and the ACA are two requirements that cannot be ignored. Failure to comply with either law can result in significant fines for both small and large companies alike. Since the enactment of ERISA and the ACA, organizations are faced with implementing – and communicating – more than 80 employee benefit regulations, including notices and documents that are required to be distributed.

What is the Affordable Care Act (ACA)?

The ACA (also known as the Patient Protection and Affordable Care Act or ‘Obamacare’) is a United States Federal Statute that was signed into law on March 23rd, 2010, requiring that all U.S. citizens have medical insurance or pay a penalty.1 The primary intent of the law was to ensure that United States citizens who were previously uninsured would have access to affordable medical insurance coverage, either through the federal or state marketplaces (exchanges) or through the expansion of Medicaid, depending on the state. Medical insurance was made more affordable by the availability of subsidies, also known as premium tax credits, which could be accessed by households with incomes between 100% and 400% of the federal poverty level.

Who must abide by the ACA?

All U.S. citizens must abide by the ACA by proving they have coverage through either an individual policy, their employer’s policy, by Medicaid/Medicare, or have proof of exemption for the 2018 reporting year. In addition, the ACA includes an “employer mandate” that requires all businesses with 50 or more full-time equivalent (FTE) employees provide affordable health insurance to at least 95% of their full-time employees, and dependents up to age 26, or pay a penalty. The medical insurance plan offered must meet the definition of minimum essential coverage (MEC), as well as pass the test for cost-sharing requirements related to deductibles, copays, and coinsurance.

What must employers do to abide by the ACA?

Employers with fewer than 50 full time employees have no mandates to fulfill regarding the ACA unless they offer employer-sponsored self-insured health coverage. If they do, they must provide a form 1095-B, which reports on the type of coverage employees have, dependents covered by the employee’s insurance policy, and the period of coverage for the prior year. Employers with 50 or more full time employees (known as Applicable Large Employers, or ALEs) must provide the health insurance described above or face penalties.

ALEs must file Form 1095-C (Employer-Provided Health Insurance Offer and Coverage) and Form 1094-C (Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns) with the IRS annually, no later than February 28 (March 31 if filed electronically) of the year immediately following the calendar year to which the return relates. ALEs must also provide a statement to each full-time employee, which includes the same information provided to the IRS, by January 31 of the year immediately following the calendar year to which the information relates.

The Affordable Care Act (ACA) imposes demanding information reporting responsibilities on employers. The reporting stipulation states that an information return will be prepared for each applicable employee, and these returns must be filed with the IRS using a single transmittal form (Form 1094-B & 1095-B or Form 1094-C & 1095-C). The filing requirements are based on an employer’s health plan and number of employees. Inability to file or report correctly will result in numerous and expensive fines for employers.

ACA Compliance Issues Confronting Employers

1) Employer Tracking: Employers need to measure and track variable-hour employees to determine their responsibility under the ACA Employer Mandate and determine which employees must be provided an offer of coverage. This is exceptionally tedious for employers with large variable-hour workforces or those with high employee turnover. When it comes to reporting, compiling this information to determine whether they need to participate in reporting can be equally complicated.

With Ease:

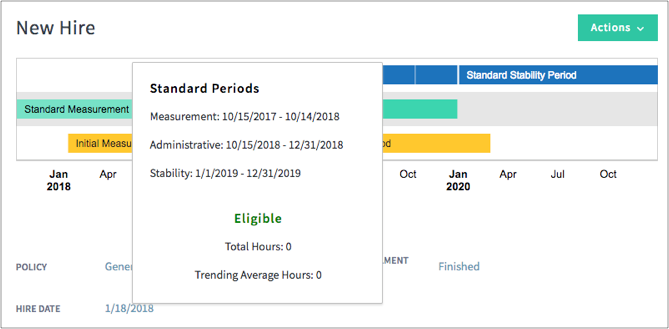

Your Ease subscription includes an ACA compliance module for all of your groups, with year-round measurement and tracking capabilities that uses enrollment data already in the system. If an employer does not have enrollment data or payroll information stored in Ease for each month of the reporting year, Ease provides easy-to-use templates to import employee data for hours worked, and both current and historical demographic information and benefits elections. Eligibility for variable-hour workers can be tracked and measured monthly, or by implementing look-back measurement and stability periods.

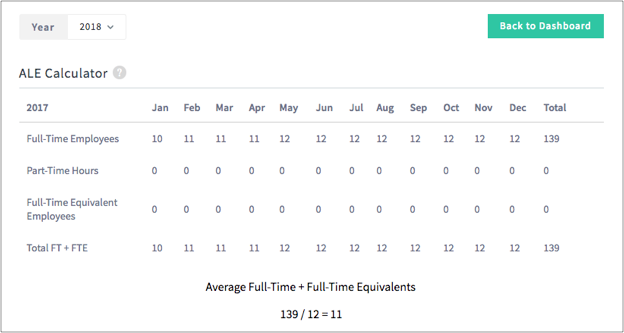

To further ensure your groups are compliant, Ease provides an ALE Calculator that helps determine the number of full-Time Employees, plus the number of full-Time Equivalent (FTE) Employees an employer has to determine if the company is an applicable large employer and therefore responsible for ACA reporting.

The calculator walks an employer through importing Part-Time, Variable-Hour, and Seasonal employees in order to determine the FTE calculation.

2) Employer Reporting: Employers are required to demonstrate compliance with the ACA Employer Mandate through annual reporting. As a means of proving compliance, all employers with 50 or more full-time or full-time-equivalent employees are subject to Section 6056 reporting. Section 6056 reporting is the required reporting to the IRS of information relating to offers of health insurance coverage by employers that offer group health plans including the months full-time or full-time-equivalent employees were enrolled in that coverage. This reporting requirement has added challenges for employers, providers and brokers alike.

With Ease:

Employers can generate signature-ready 1094-B/1094-C and 1095-B/1095-C Forms for $6 a piece. The forms are generated directly in Ease, and can be accessed by using the 1094-C and 1095-C tab within the ACA module.

The values calculated in the 1095-B/1095-C forms are based on plan eligibilities determined in the system when coverage was offered, and is based on new hire or variable hour measurement periods, plan costs, and employee compensation data entered into Ease.

Because the information is required to be present in ACA with Ease, the 1094-C and 1095-C forms are already built into the ACA tool. This automates the process, saves your group time, and greatly improves the accuracy of the reporting data. Reporting accuracy is important and mistakes can be costly, ACA with Ease helps lessen the burden surrounding this issue.

When it comes time for filing, all 1095-C outputs can be generated and exported into a .csv file. For employers that have to e-file, they can use this file generated from the ACA module to electronically file. Ease also has partnerships with third parties that can help with electronic submission.

What is ERISA?

In addition to challenges associated with ACA compliance, employers are still required to keep up-to-date with the Employee Retirement Income Security Act (ERISA), state, and other ACA federal requirements imposed upon benefit plans. Maybe you break it up into two sentences and say: ERISA establishes minimum standards for retirement (pension plans), health, and other welfare benefit plans, including life insurance, disability insurance, and apprenticeship plans. These standards help to protect not only employees, but employers too. It does not require employers to offer plans but sets important standards for employers that do.

ERISA essentially establishes a set of rules governing the benefits employers choose to offer. The Department of Labor (DOL), the Employee Benefits Security Administration (EBSA), and the Department of Treasury collectively administer and enforce the law. The Health Insurance Portability and Accountability Act (HIPAA) of 1996 and the Consolidated Omnibus Budget Reconciliation Act (COBRA) of 1985 also fall under the umbrella of ERISA.

Who must abide by ERISA?

Corporations, partnerships, sole proprietorships, and non-profit organizations must abide by ERISA. Once these organizations offer a health, life, disability or protected plan, that plan is subject to ERISA. Governmental employers and churches are exempt from the law.

What must employers do to abide by ERISA?

There are several provisions mandated under ERISA, such as, but not limited to, conduct, reporting, accountability, disclosures, and procedural safeguards. An important provision that is often overlooked is the disclosure requirement, which is in reference to medical, dental, vision, disability, and life insurance plans. ERISA states that all employers offering these types of plans, regardless of size, must provide all beneficiaries (employees enrolled in the plans) with a Summary Plan Description (SPD); a document that clearly lists the benefits being offered, the rules for obtaining those benefits, the plan’s limitations and/or exclusions, and other guidelines for utilizing benefits such as obtaining referrals for specialist visits or surgery. The Evidence of Coverage booklets provided by the insurance carriers generally do not meet these requirements, and the employer is out of compliance if an SPD is not accessible to all enrolled employees.

ERISA Compliance Issues Confronting Employers

1) Summary Plan Document (SPD): Employers are legally obligated to provide to participants, free of charge, the Summary Plan Document. Summary Plan Descriptions (SPDs) are the primary means for informing participants and beneficiaries about what the plan provides and how it operates. It provides information on when an employee can begin to participate in the plan, how services and benefits are calculated, when benefits become vested, and how to file a claim for benefits. The SPD translates the legalese in the ERISA plan document, which is a legal document that governs the plan and its administration, into language that is “calculated to be understood by the average plan participant,” as referenced under 29 U.S.C., Section 1022(a).

The Department Of Labor has developed extensive regulations that explain what must be included in an SPD. Much of the required information is provided by carriers, but the carriers cannot cover all of the requirements. The SPD may incorporate the carriers’ Evidence of Coverage (EOC), which generally provides sufficient descriptions of the plan’s benefits. However, the SPD must also include employer-specific content, such as an ERISA plan number, Employer Identification Number, plan financing method, and other information not contained in an EOC or Summary of Benefits Coverage (SBC).

Many employers choose to “wrap” all their plans’ EOC and SPD documentation together and distribute it as one combined piece; this is referred to as a “wrap document.” The wrap document is a single document containing all of the required information, which is simpler than having multiple separate documents for all lines of coverage offered by the employer. The SBC, however, is not part of the wrap document (or any ERISA document, for that matter) and must be distributed in addition to the SPD/wrap information.

With Ease:

Ease’s document library enables you to securely make important company documents, like Summary Plan Documents or Summary of Benefits Coverage, available to employees. In setting up the Document Library, folders can be useful to organize your groups’ resources. For example, you can add a specific folder for ERISA compliance documents like SPDs and SPCs.

You can utilize the description section while uploading forms to your document library to add an explanation or further information that would be useful to the employee, and it will display below SPD Display Name in the Document Library. Using this tool will help highlight the availability of the SPD.

To ensure ERISA compliance, and employee acknowledgement of SPD’s, your groups have the capability to require a review, or require a signature to prove they have seen the documents and are aware of their coverage. By making review required, employees must open the link or document before they can complete their onboarding requirements and sign their W-4 and I-9 forms. By selecting ‘require signature’, employees are required to add their signature acknowledgment, verifying they have read and understood the contents of the SPD before continuing with the rest of the onboarding requirements.

2) Summary of Benefits Coverage (SBC): Health insurance carriers are required to create Summaries of Benefits and Coverage, called SBCs, which are written summaries of the benefits and coverage contained in a plan. Sometimes an employer is responsible for creating an SBC if it sponsors a self-funded health insurance plan.

SBCs are a requirement that became effective in September 2012 as part of the ACA. SBCs all have a uniform format, intended to help health insurance consumers compare plans and benefits when deciding to enroll in a plan. Employers are required to distribute SBCs without charge to participants and beneficiaries for every medical benefit plan offered by the employer/insurer when an employee first becomes eligible to enroll, or during the employer’s open enrollment. SBCs must also be provided to employees upon request.

SBCs must contain:

- Descriptions of coverage (including coinsurance, copay amounts, and deductibles) and information related to coverage limitations

- Coverage examples to show how the plan will work in sample medical situations

- A corresponding uniform glossary with each SBC, which defines all terms mentioned in the carriers’ SBCs

With Ease:

One of the main benefits of Ease is the ability to add plans directly into the Company Portal using our Plan Library. With a Plan Library you can:

- Add a plan profile, eligibility rates, necessary forms, and documents to each plan template

- Ease the burden of your groups’ ERISA compliance concerns by addings an SBC directly into the plan’s Documents page in the Plan Library

- Require review of the SBC, ensuring employees are aware of the document, and can refer to it whenever questions arise about their coverage

Conclusion:

For your groups, achieving and maintaining compliance might seem like a tall order, but with your support and the help of Ease, avoiding fines doesn’t have to be a struggle.

Interested in learning more about Ease compliance tools? Check out these resources below:

Questions? Reach out to [email protected]

Index:

1 https://www.healthcare.gov/glossary/patient-protection-and-affordable-care-act/